Tax Deductions and Energy Credits for Door Replacements Before Year-End

Dec 27th 2025

Door replacements are often viewed as an aesthetic upgrade, yet they also play a key role in home efficiency. A well-insulated front door reduces drafts, lowers heating costs, and improves overall comfort. Many U.S. homeowners do not realize they can earn federal tax credits for choosing energy-efficient exterior doors. These credits fall under the Energy Efficient Home Improvement Credit, which rewards homeowners who make qualifying upgrades before year-end. Replacing your door now could lower your energy bill and reduce your tax burden.

Understanding the Federal Energy Efficient Home Improvement Credit

The Inflation Reduction Act expanded and updated this credit to make energy-saving improvements more accessible. According to the IRS, homeowners can receive a credit equal to 30 percent of the cost of qualifying upgrades. Exterior doors have their own category within this program. The IRS notes that a homeowner can claim up to $250 per qualifying door, with a maximum of $500 each year.

This credit applies only to primary residences located in the United States, and the doors must meet specific efficiency standards set by ENERGY STAR®.

What Makes a Door “Energy Efficient”?

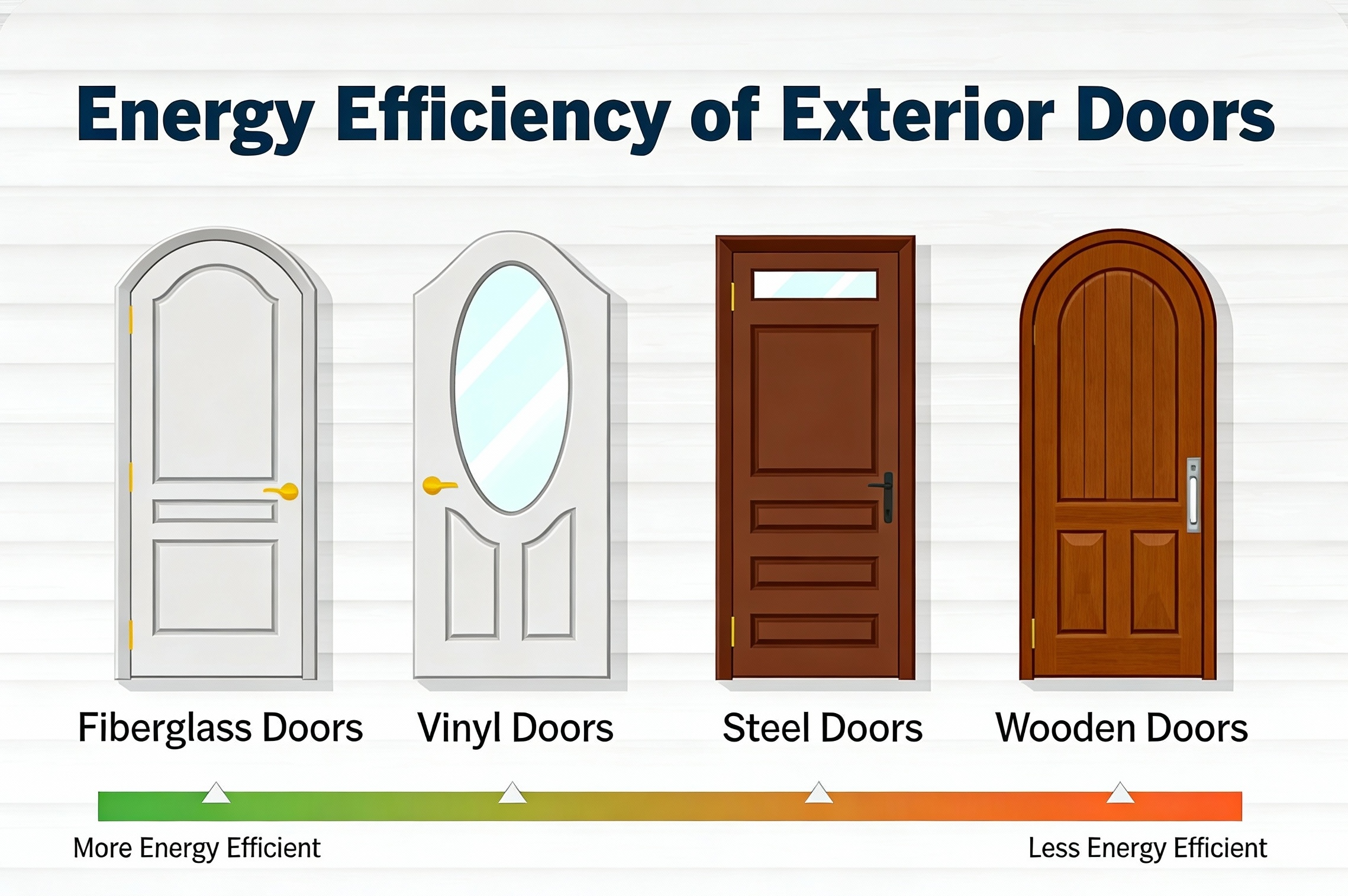

The Department of Energy explains that energy-efficient exterior doors minimize heat transfer and air leakage. To qualify for credits, doors must meet ENERGY STAR® criteria based on your climate zone. ENERGY STAR notes that certified doors can lower energy costs by reducing heat loss in winter and heat gain in summer. You can read more about these requirements through ENERGY STAR.

In simple terms, a qualifying door should have:

- A strong insulated core

- High-performance glass, if the door includes glass

- Tight seals that limit drafts

Knockety offers several fiberglass and solid-core doors that align with these standards.

Why Replacing Before Year-End Matters

Federal tax credits apply based on the year the project is completed, not when the project is purchased. If you want to claim the credit on your upcoming tax return, the new door must be installed by December 31. The IRS clearly states that improvements must be “placed in service” during the tax year to qualify. That means no credit for partial installations or doors that are still on order.

Homeowners also benefit from lower winter utility bills when a new, efficient door goes in before the coldest months hit. The Department of Energy reports that heat loss through doors and windows can significantly increase heating costs, especially in older homes.

State and Utility Rebates May Add Even More Savings

In addition to the federal tax credit, many states and energy providers offer rebates for efficient home upgrades. The Database of State Incentives for Renewables and Efficiency lets homeowners search for door-related incentives by ZIP code. Some programs offer up to a few hundred dollars back for installing ENERGY STAR-certified doors. These rebates stack with the federal credit, making year-end replacements even more cost-effective.

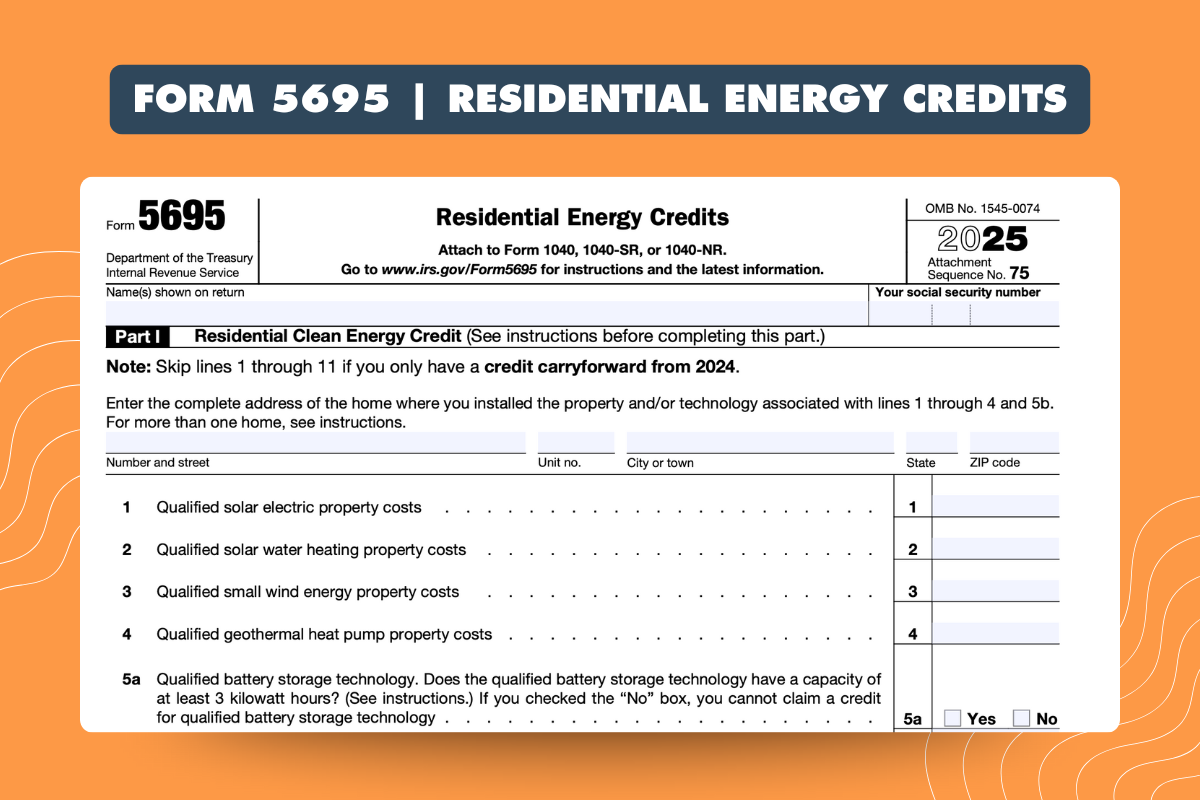

How to Claim the Tax Credit

The IRS requires homeowners to file Form 5695 when submitting their federal income tax return. You must keep sales receipts and certification documents that prove the door meets ENERGY STAR standards. The IRS recommends keeping these records for your files even though you do not submit them with the form.

Replacing multiple doors may increase your total credit, but the annual cap remains at $500 for exterior doors.

Why Door Quality Matters When Seeking Energy Credits

Tax credits reward efficiency, not minimal upgrades. A low-quality door may look appealing, yet it will not deliver long-term savings or qualify for credits. High-performance fiberglass and insulated doors reduce drafts and help your HVAC system work less. That stability protects your home’s comfort and lowers monthly bills. ENERGY STAR notes that efficient doors can reduce energy use by up to 12 percent, depending on climate.

Knockety doors are designed with solid craftsmanship, insulated cores, and tight thresholds, features that support strong performance in every season.

Replacing your front door before year-end can lead to immediate comfort improvements and meaningful tax savings. With federal credits, state rebates, and lower utility costs, choosing an energy-efficient door makes financial sense. When you combine smart incentives with a high-quality Knockety door, you upgrade more than your entryway. You upgrade the way your home uses energy.

Explore Knockety’s collection of energy-efficient doors and see which models may help you claim savings this tax season.